Welcome to the latest edition of "Connecting the Dots in RegTech," your weekly source for the most significant developments in the world of regulatory technology. 🙌

Let's connect the dots and explore these intriguing stories shaping the world of RegTech and financial regulation. 👈

👀 NEWS HIGHLIGHT

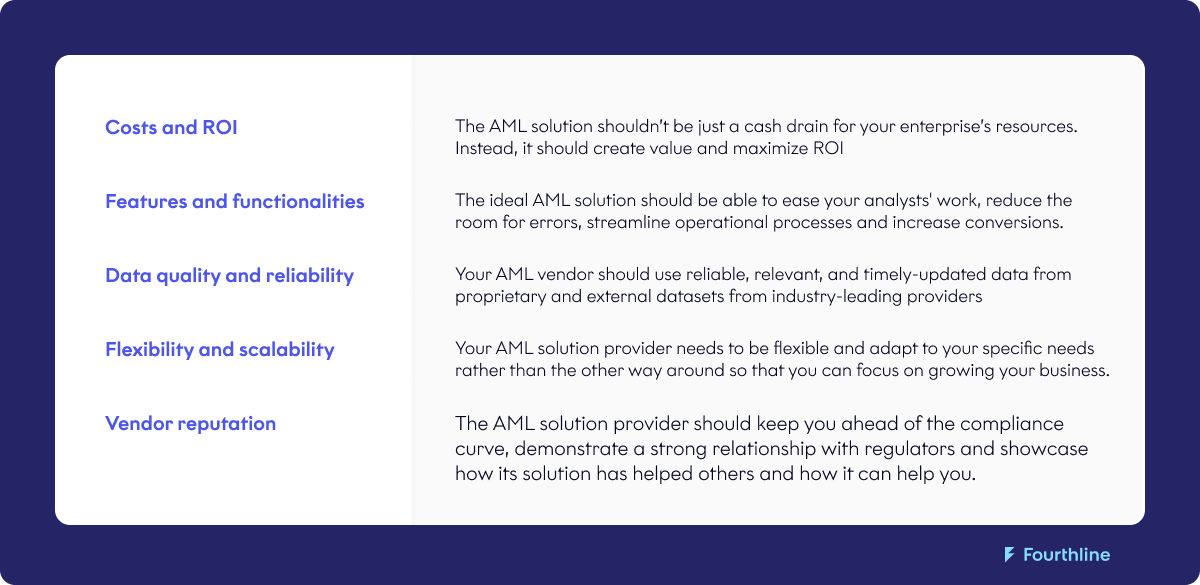

Choosing the right AML screening solution requires going beyond product features and functionalities.

Explore the 5 essential factors to consider in this comprehensive article from Fourthline:

😎 SPONSORED CONTENT

👨💻 BLOG

The regtech market revenues were estimated at US$ 8.2 Billion in 2021 and are anticipated to grow at a CAGR of 16.2% from 2022 to 2032, according to a recently published Future Market Insights report. By the end of 2032, the market is expected to reach a valuation of US$ 45.3 Billion. Market revenue through cloud-deployed RegTech grew at a CAGR of 22.6% from 2015 to 2021.

💡INSIGHTS

In a recent webinar by RegTech firm Alessa, the firm discussed what you need to know to help ensure compliance when it comes to crypto assets.

As the popularity of cryptocurrencies surges, it’s crucial to enhance your skills in identifying and reporting suspicious activities involving these digital assets. Alessa’s expert panel delved into significant regulations and shares practical advice, including recognizing risky wallets and transactions, particularly those that are mixed or tumbled. A key question arises: when will enforcement for Non-Fungible Token (NFT) wash trades become a central discussion point?

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 REGTECH HIGHLIGHTS

⭐️ Cable releases automated transaction testing tool.

⭐️ Lloyds Bank launches in-app passport scanning for customer onboarding.

🌎 REGIONAL HIGHLIGHTS

EUROPE 🇪🇺

European Banking Authority (EBA) calls for enhanced Anti-Money Laundering rules for crypto providers – Regulation incoming? In a consultation paper, the banking regulator of the EU acknowledged that current regulations lack the necessary teeth to ensure compliance with AML/CFT standards in the crypto industry.

LATAM

Floid has joined forces with Mastercard to enhance digital transaction security and transparency across the region. This collaboration is a result of Floid's selection as the first Latin American fintech to join Mastercard's Start Path Open Banking program.