Welcome to this week's edition of Connecting the Dots in RegTech newsletter, your go-to source for the latest developments and insights in the world of regulatory technology.

✴ In this week's newsletter, we delve into a range of topics shaping the RegTech landscape. We'll explore the global regulatory landscape for cryptocurrencies, examining the impact of IOSCO's new regulations.

✴ Additionally, we'll cover the recent charges against the founders of Tornado Cash, a popular crypto mixer, and their potential implications for the crypto space.

Lastly, we'll delve into KPMG's perspective on the intersection of artificial intelligence and RegTech, offering a glimpse into the transformative potential of AI in compliance and regulatory processes.

👉Stay informed and connected with our curated insights on the ever-evolving world of RegTech.

REPORT

🥋 𝟭𝟬 𝗦𝗘𝗖𝗥𝗘𝗧 𝗙𝗥𝗔𝗨𝗗-𝗙𝗨 𝗧𝗘𝗖𝗛𝗡𝗜𝗤𝗨𝗘𝗦! 🥋by Luke Raven

The goal is simple:

💪 Turn soft targets hard.

💸 Maybe, someone remembers this in a crucial moment.

💸 They pause to contact a trusted person who can help steer them straight.

💸 Or they remember before clicking "send" on that funds transfer.

💸 Or they hesitate before following a link they've been sent...

👀 NEWS HIGHLIGHT

The program helps AWS partners drive new business by directly connecting participating ISVs with the AWS Sales organization.

The AWS ISV Accelerate Program provides ComplyAdvantage with co-sell support and benefits to meet customer needs by working with AWS sellers globally, who service millions of active AWS customers. Co-selling provides better customer outcomes and assures mutual commitment from AWS and Armis.

😎 SPONSORED CONTENT

📊 INFOGRAPHIC

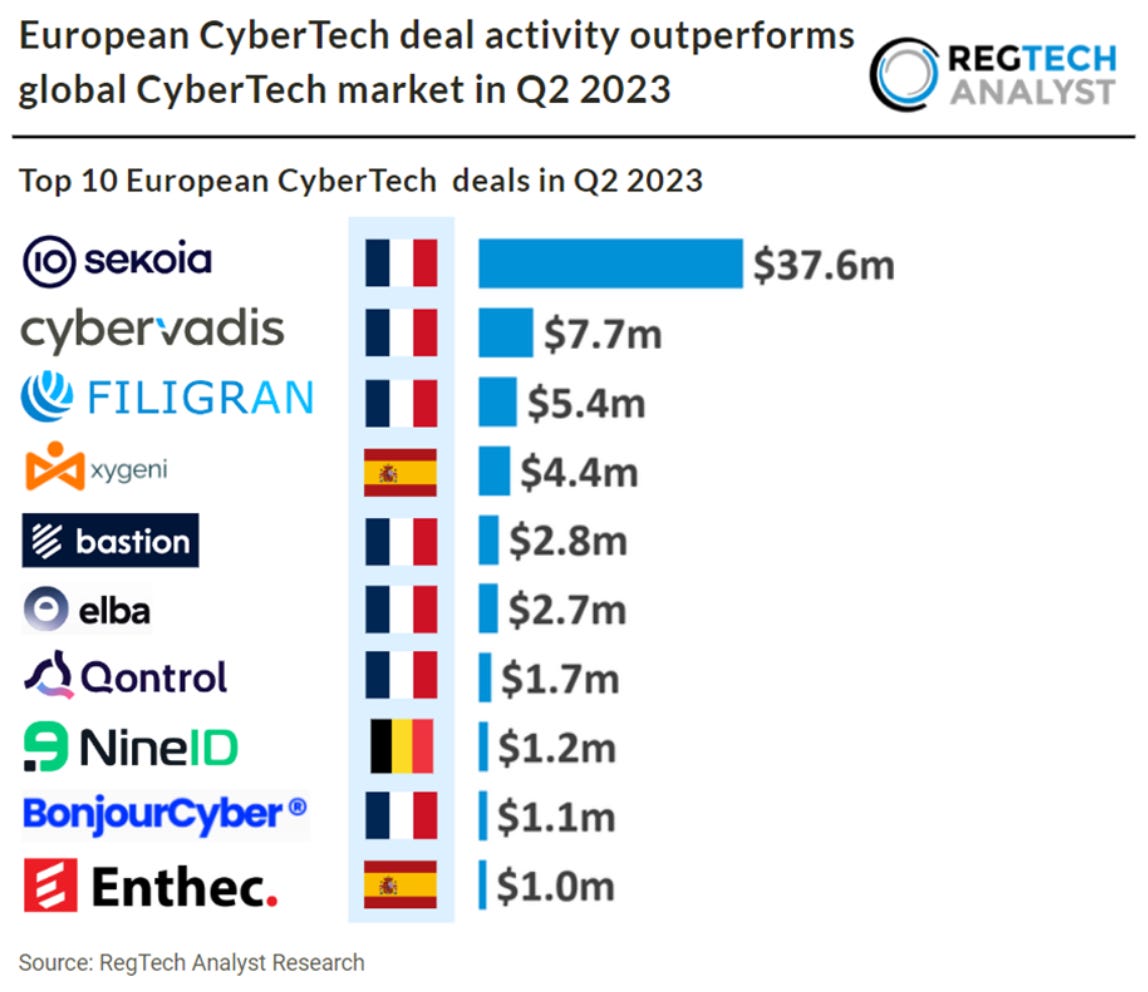

CyberTech deal activity outperforms global CyberTech market in Q2 2023

Key European CyberTech investment stats in Q2 2023:

‣ European CyberTech deal activity reached 49 funding rounds in the second quarter, a 9% drop from Q2 2022

‣ European CyberTech companies raised a combined $83m in Q2 2023, a 73% drop YoY

‣ Global CyberTech deal activity dropped 16 percentage points more than European CyberTech deal activity in Q2 2023

📰 ARTICLE

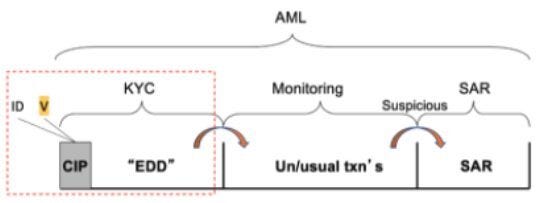

KYC/B is not AML.

Both concepts are closely related but distinct, so let's break them down:

We see this far too often. Some companies believe they’re handling AML efforts but are really only focused on the KYC/B part of it.

Read the complete source update by Brock Bontrager here.

Is Crypto Really Ready For MiCA?

Reflecting on the tumultuous crypto landscape of 2022 evokes images of a high-speed train with a few missing rails—undeniably exhilarating, yet its sustainability remains questionable. As the EU introduces the landmark MiCA (Markets in Crypto Assets) regulation, the pressing question emerges: Is the crypto world truly prepared to adapt?

Read the whole article here.

👨💻 BLOG

In this follow-up to an earlier blog series, Mark Dangelo speaks to Michael Gialis, a Partner at KPMG, about how AI-enabled Reg-Tech can impact the day-to-day workflow of many auditing and tax & accounting professionals in profound ways.

💬 INTERVIEW

Why PayPal's stablecoin is likely to succeed where Facebook's Libra failed.

The world has changed dramatically since Facebook's Libra project. There was no familiarity with stablecoins whatsoever, said Christopher Giancarlo, former chair of the U.S. Commodity Futures Trading Commission.

💡INSIGHTS

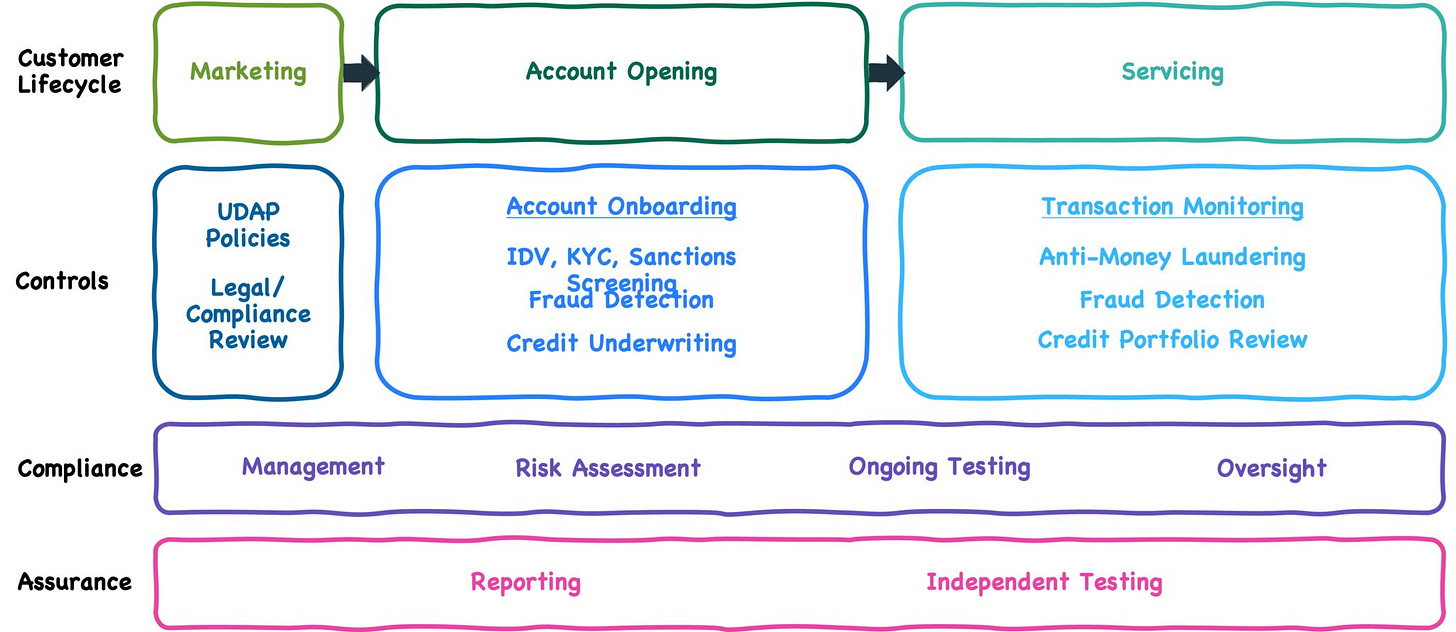

🏦Traditionally, banks design their risk, governance, and compliance processes across three lines of defense:

Read the whole article on this topic by Alex Johnson and Cable here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 REGTECH HIGHLIGHTS

⭐️ The International Organization of Securities Commissions (IOSCO) recently announced the world’s first global approach to regulating crypto and digital markets.

⭐️ ‘Mule’ used ANZ bank account to steal money from up to 9 scam victims, calling for financial liability.

⭐️ Tornado Cash founders charged with money laundering and sanctions violations.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

LendInvest adopts DirectID solutions to streamline the lending process. By using DirectID’s solutions, LendInvest has simplified its process of verifying income and deposit funds and credit risk.

Griffin’s customer onboarding solution, now comes pre-integrated with Veriff’s ID&V (Identity & Verification) technology, allowing fintechs to carry out biometric checks and onboard new users quickly and securely.

EUROPE 🇪🇺

Switzerland's financial regulator looked into the risk of money laundering at 30 banks this spring, after identifying shortcomings in the area.

Europe's tough new rules for Big Tech. The Act (DSA) sets rules that the EU designed to make very large online platforms (VLOPs) "tackle the spread of illegal content, online disinformation, and other societal risks" presented by online service providers."

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.