Welcome to this week's edition of Connecting the Dots in RegTech, your go-to source for the latest updates and insights in the world of regulatory technology. In this issue, we delve into some intriguing developments: the UK government's proposals for new Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) models, a right-wing think tank's recommendations for reshaping the UK's Know Your Customer (KYC) approach to excel in the Web3 era, and an in-depth podcast discussion that takes you on an AML deep dive journey with Dutch regulators, Deloitte specialists, private sector experts, and more. Keep scrolling for a comprehensive overview of the ever-evolving RegTech landscape!

👀 NEWS HIGHLIGHT

In a bid to position itself as a global hub for Web3 technology and crypto innovation, the United Kingdom is being advised by a prominent conservative think tank to reconsider its regulatory approach. Policy Exchange, a respected institution in the UK, has released a report outlining ten proposals aimed at enhancing the country’s Web3 regulatory framework.

😎 SPONSORED CONTENT

📰 ARTICLE

Fraudsters can gain access to a phone's data and clone it in a number of ways. For example, they can use a SIM scanner, which is a small device that enables them to scan a phone from a short distance, or an app that they download onto their own phone.

Read the full article here

Money laundering is the process of “cleaning” funds coming from illicit activities to make their origin seem legal. From the first records of money laundering back in 2000 BCE to the modern day, these practices and techniques have evolved significantly. Fortunately, so have the methods designed to counteract them.

Read the full article here

💡INSIGHTS

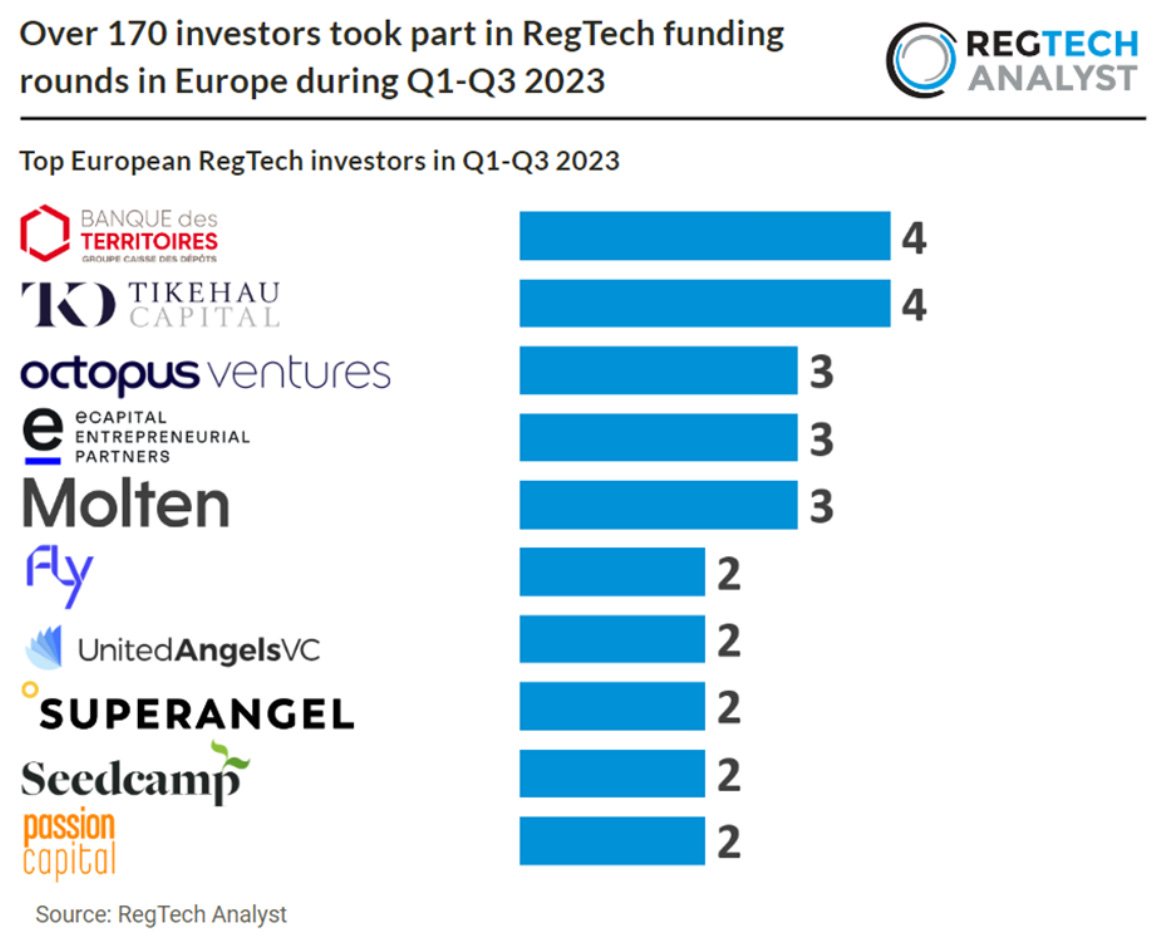

Over 170 investors participated in RegTech funding rounds during Q1-Q3 2023, and notably 80 were added during Q3 alone.

European RegTech deal activity continues to be active in 2023 with 155 deals taking place from Q1-Q3 2023, no change from the same period in 2022.

🎤 PODCAST

Welcome to an extra episode of Leaders in Finance. This episode was recorded live from the Leaders in Finance AML Netherlands event that took place on 5 October 2023. We had 5 distinguished speakers with whom we reflected on the event.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 REGTECH HIGHLIGHTS

⭐️ Regime reform: UK government proposes new AML/CTF models.

⭐️ Jack Henry rolls out Financial Crimes Defender.

⭐️ Revolut grows financial crime headcount to combat rising fraud levels.

🌎 REGIONAL HIGHLIGHTS

EUROPE 🇪🇺

TransactionLink has raised a €5m seed round to expand its KYB (know your business) product into new sectors and grow its co-headquarters in Berlin and London.

USA 🇺🇸

The Financial Conduct Authority (FCA) has fined Equifax over £11 million for failing to protect their customers from a data breach outsourced to its US parent company.

AUSTRALIA 🇦🇺

The Commonwealth Bank of Australia (CBA) has activated its digital identity service ahead of forthcoming legislation to enable the creation of a national ecosystem, as banks race to monetise transactions using the credential ahead of a widespread rollout expected over the next two years.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.