Welcome to this week's edition of Connecting the Dots in Regtech! 💥

Amongst many topics, we dive into the hot discussions currently unfolding in Germany regarding Video-Ident and the challenges faced by German companies, especially financial institutions, in complying with KYC processes due to stringent regulations like the EU Anti-Money Laundering Directive and local regulatory requirements.

➡️We'll also explore the UK's efforts to combat financial crime with the Economic Crime and Corporate Transparency Bill, focusing on enhancing data sharing, fraud detection, and identity verification within the financial ecosystem.

Stay tuned for the latest insights and developments in the world of regulatory technology. 📊

REPORT

Fintech Spotlight 2023: A focus on profitability by Plaid

Download the Fintech Spotlight 2023 to learn:

‣ Four approaches for a better bottom line.

‣ How to rebuild crypto services through trust and profitability.

‣ Three ways to use data to solve lending challenges.

Download the complete report here.

😎 SPONSORED CONTENT

REPORT

7 no-regret moves by Roland Berger. Fraud prevention & AML compliance is #1 of 7

Check out the full report here.

👀 NEWS HIGHLIGHT

Fourthline has joined forces with SaaScada, the cutting-edge NextGen data-driven core banking engine!

📰 ARTICLE

Europe has the strictest regulatory compliance rules. However, most of these rules impose strict fines on big tech companies. Smaller and independent companies are not taking data privacy and transparency seriously enough.

Read the full article here.

Interestingly, the convergence of cryptocurrencies and AML compliance prompts profound inquiries: How can we uphold transaction integrity in a decentralized landscape? What mechanisms can strike a balance between privacy and accountability?

Read the full article here.

💡INSIGHTS

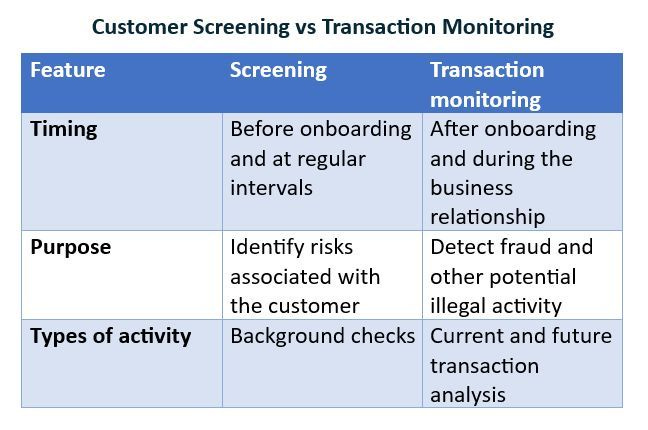

Anna Stylianou published an update diving into the critical roles of Screening and Transaction Monitoring in the financial sector. 🕵♀️🔍

📌Screening: A pre-approval process that compares customer data against various watchlists to identify risks, like potential involvement in money laundering or terrorism. It's crucial to understand the type of customers you're dealing with.

📌Transaction Monitoring: This involves tracking and analyzing customer transactions in real-time or retrospectively to identify suspicious activities such as fraud, large or irregular transactions, or dealings with high-risk entities.

Amid S$1 billion money laundering probe, a look at how dirty money is washed through online gambling

Online gambling and virtual assets were involved in Singapore’s S$1 billion money laundering case. Financial fraud expert Kelvin Law from NTU looks at how online gambling is a haven for money launderers.

Know your customer: intelligently optimize identity checks with AI.

This article discusses the challenges that German companies, particularly financial institutions, face in complying with KYC processes due to the EU Anti-Money Laundering Directive and local regulations. It examines various KYC methods, such as Video Identification (Video-Ident), Personal Identification (Post-Ident), and Electronic Identification (eID), outlining their pros and cons.

The article also introduces the "German Flow," a fully digital KYC solution that combines biometric data, address verification, and bank account confirmation and aims to streamline the compliance process for financial institutions while maintaining user-friendliness and scalability.

A short explanation of KYC/onboarding in the Germany by Fourthline Team here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 REGTECH HIGHLIGHTS

⭐️ Germany faces €206 billion in cybercrime and digital theft costs.

⭐️ The UAE's Ministry of Economy suspended 50 businesses for three months for failing to register in the anti-money laundering system (goAML) of the Financial Intelligence Unit (FIU).

⭐️ Gambling regulator withheld documents from money laundering inquiry.

⭐️ Marqeta appoints Chief Information Security Officer, Heather Gantt-Evans.

⭐️ The International Monetary Fund published a report highlighting key vulnerabilities in Côte d’Ivoire's anti-money laundering and counter-terrorism financing (AML/CFT) initiatives.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

The UK's rise as a fintech hub and financial services powerhouse has made it a global force, yet it has also become a prime target for criminal exploitation. Read how incoming regulations could affect the UK open banking market.

Mercuryo became a member of the FinTech FinCrime Exchange (FFE) – an international initiative aimed at combating financial crime.

OneID secured £1 million in new funding from ACF Investors.

UK gov’t urged against delay in setting AI rulebook as MPs warn policymakers aren’t keeping up.

EUROPE 🇪🇺

Regulator’s review of over 30 Swiss banks finds shortcomings in money-laundering controls.

Switzerland said it had drafted new rules to tighten perceived cracks in its money laundering regulations, holding lawyers and consultants accountable for reporting risks and stepping up oversight of legal entities, such as trusts.

BBVA became the first bank in Spain to make registration and login available to its customers at online retailers and service providers through a new Bizum service.

The Financial Supervision Authority fined Estonian LHV Pank €900,000 for shortcomings in its anti-money laundering and counter-terrorism funding efforts.

Santander has teamed up with dating guru Anna Williamson to warn of the ‘love language’ to look out for as romance scammers hit on a third of Brits.

USA 🇺🇸

Damian Williams and Michael J. Driscoll announced the unsealing of an Indictment charging NATHANIEL CHASTAIN, a former product manager at Ozone Networks, Inc. d/b/a OpenSea (“OpenSea”), with wire fraud and money laundering in connection with a scheme to commit insider trading in Non-Fungible Tokens, or “NFTs,” by using confidential information about what NFTs were going to be featured on OpenSea’s homepage for his personal financial gain.

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued a new round of sanctions targeting prominent members of Russia’s financial elite, as well as a Russian business association.

Helix announced the launch of Helix Institutional, enabling the trading of DeFi derivatives products in a permissioned, KYC-enabled environment.

Altum Group implemented RiskScreen’s KYC platform to augment its onboarding procedures and comply with regulatory landscapes.

Astra partners with Plaid to launch instant authenticated payments with Plaid Identity Verification.

CANADA

Westpac launches first Australian real-time bank fraud algorithm for payments | The Mercury.

ASIA

Safexpay introduces APIX, an integrated RegTech platform that provides a comprehensive set of API solutions within a unified framework.